Many of our customers have been facing increasing premiums over the last 18 months as market capacity reduces, resulting in some businesses finding it difficult to obtain insurance.

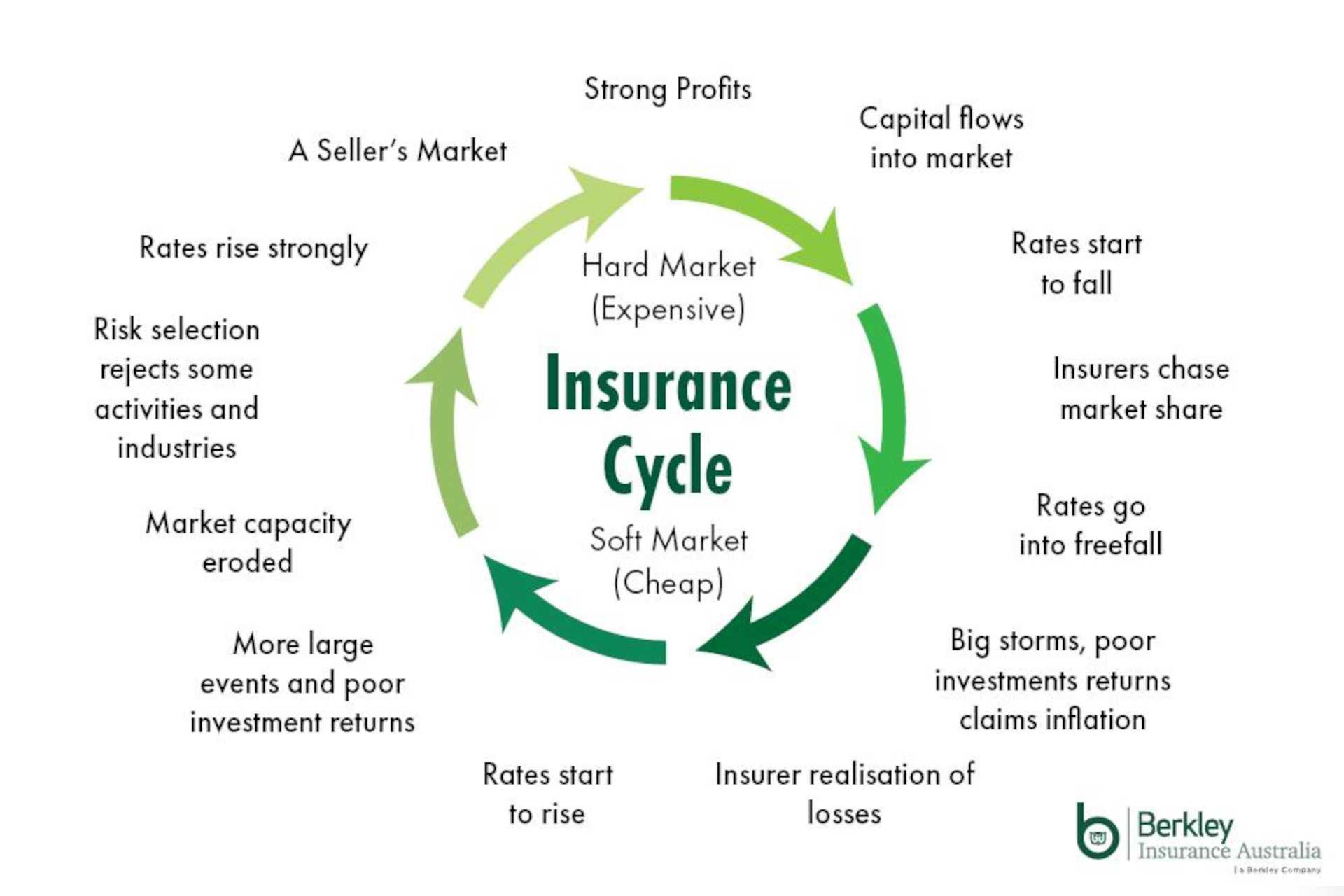

The following excerpt from an article provided by one of our suppliers “W R Berkley” explains in plain English how the insurance market cycle works and why premiums increase and reduce.

The insurance market is cyclical, moving through both hard and soft markets. A soft market is generally characterised by low rates, high limits and readily available cover. In a hard market premium increase and capacity will generally decrease. This can be caused by several factors:

• falling investment returns / low interest rates

• increases in frequency or severity of losses

• reduced capacity

• cost of reinsurance

• regulatory intervention

Low interest rates mean that insurers can no longer rely on their investment returns to bolster unprofitable results. When interest rates are low insurers focus on underwriting profitability which means raising premiums, tightening underwriting guidelines and being more selective about risk.

In general insurance claims are increasing because of social inflation, which is the societal trend towards increased litigation, broader contract terms, plaintiff-friendly legal decisions and larger jury awards. An example of this is the increased number of Securities Class Actions (think Centro Group, Commonwealth Bank, Takata airbags) seen over recent years.

Because of significant losses ($1.8 Billion in 2018), Lloyds of London Decile 10 review resulted in several unprofitable Lloyd’s syndicates exiting the Australian market resulting in reduced capacity and a retraction in the number of underwriting agencies who have typically participated in the hard-to-place risks.

Reinsurance is the insurance that insurance companies purchase to protect their bottom line. Recent times have seen the cost of reinsurance increasing due to the large number of catastrophe losses around the world. This additional cost is then passed down to the consumer. S&P Global Ratings noted that reinsurers saw property catastrophe rate increases in the range of 15% to 25% in the second half of 2019.

The market is likely to remain hard for the balance of 2021 and well into 2022. However, you should always discuss your situation with one of our brokers who understand the market and what suppliers may be prepared to do for you.

Back to News